The Industrial Market and High-Density Residential Development: The Increased Demand in the Industrial Market

Booming Business

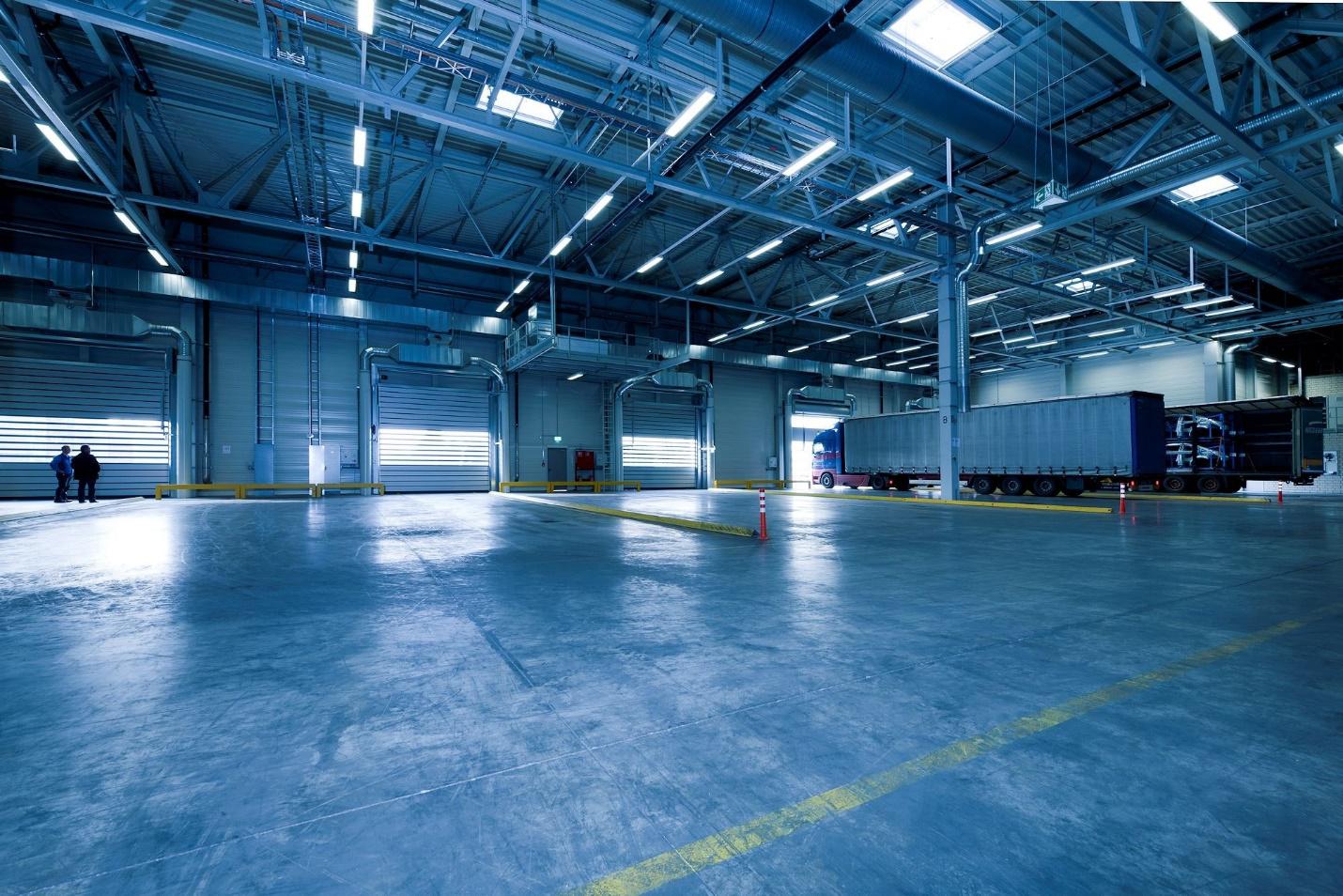

While some commercial real estate sectors, such as office buildings, have taken a hit during the COVID-19 pandemic, the industrial market is soaring in Southern California. With a current vacancy rate of 2.2%, it’s becoming increasingly more difficult for commercial tenants or buyers to find the building they need. A few factors are driving this trend.

Pandemic Pressures

Brick and mortar stores, restaurants, and office space have all struggled during the pandemic. Each of these commercial categories saw unprecedented vacancies. The demand for industrial real estate, however, is still growing dramatically. INCO Commercial sees a couple of key reasons for this trend.

- The growth of e-commerce has increased shipping. The month of May 2021 was the busiest in the Port of Los Angeles’ 114-year history. It saw a 74% increase in TEUs over the previous year. This phenomenal growth demands more warehouse and logistical space.

- Over the past year, the Port of Los Angeles and the Port of Long Beach together handled 40% of the United States shipping. This congestion has pushed into neighboring communities as companies are forced to find new space farther away from the ports.

Hot Housing

There is a continuous need for housing in the greater Los Angeles area. To meet that demand, multifamily developers are forced to look at industrial properties with overlays of high-density residential zoning. This puts an additional pressure on an already scarce commodity.

When it comes to bidding wars on a piece of industrial property, the real estate developers can pay more at times for industrial product if the property allows for a high enough density. A local company that needs more warehouse space generally finds it difficult to compete with multifamily property developers when looking for industrial building that sit with a large yard. The end result is that the agents and brokers have to dig deeper and look further to find properties for their clients. This includes digging up off market sites for clients, 80% of our deals currently in escrow came from deals that were not on the open market.

Market Measurements

If the industrial real estate market is being squeezed from both sides, what does that do to the numbers? Supply and demand still rules the day. Rents on industrial square footage have risen 6.2% while the purchase price has gone up 10.7% per square foot. Multiple tenants vying for the same space will certainly continue to drive up the rates.

This trend is likely to continue over the next few years, at least. COVID-19 has made online shopping a necessity for many people, and we have not yet seen the cap on that growth. Many companies are still behind the curve as they struggle to accommodate the e-commerce growth they’ve experienced already.

Foreseeable Future

If the agents and brokers at INCO Commercial have learned anything over the past 18 months, it’s that predicting the future is risky business. However, most analysts are confident in expecting a continued demand for industrial real estate. Some ways in which the pandemic may influence industrial properties include the following:

- Improved ventilation systems that allow for sophisticated air filtering.

- Floor plans that encourage better social distancing.

- An increase in physical barriers that keep customers, clients, and employees more separated.

As the housing crunch continues, the conversion of industrial space into residential units will continue as well. The money to be made from the conversion is too attractive for developers to ignore. Some possible developments include:

- Wrap or podium type apartment housing.

- Townhome developments both attached and detached.

- A concerted effort to rezone more commercial properties for mixed use or high-density residential zones.

California Conundrum

Southern California is a great place to live and do business. It’s no surprise that our real estate demands a premium. This can sometimes make it more difficult for local businesses to compete with larger multinationals for key commercial real estate listings. But don’t let that discourage you. The agents and brokers at INCO Commercial are experienced in the local commercial markets and are prepared to help you navigate this unprecedented real estate landscape. Call us today to learn more.