1031 Exchange & Investing in Properties Sight Unseen

You may be already well aware of the benefits that come with a 1031 Exchange, but you may not know that investing remotely is an excellent way to apply them.

To be sure, once you’ve considered the many appealing real estate markets nationwide, you’ll see that limiting yourself to your own immediate area can cost you money. Therefore, you’ll want to avoid the assumption that you need to see a property in-person in order to determine if it’s a good fit.

Of course you can’t just blindly trust that a remote property will be right for you after seeing a picture or two online! So, here are some tips to help you choose a viable, out-of-area investment property.

Perform Proper Market Research

While you would never buy a property based solely on an online description, there are a number of online tools you can use to help determine if an estate would be a good fit.

Start by looking at a potential property’s surrounding real estate market. Is it attractive? Lucrative? How profitable is it? Then, follow up with questions such as: Where has the market been? Where is it now (and likely to be in the immediate future)? Then, consider factors such as the area’s overall economic growth (or lack thereof), current job statistics, and housing market stability levels.

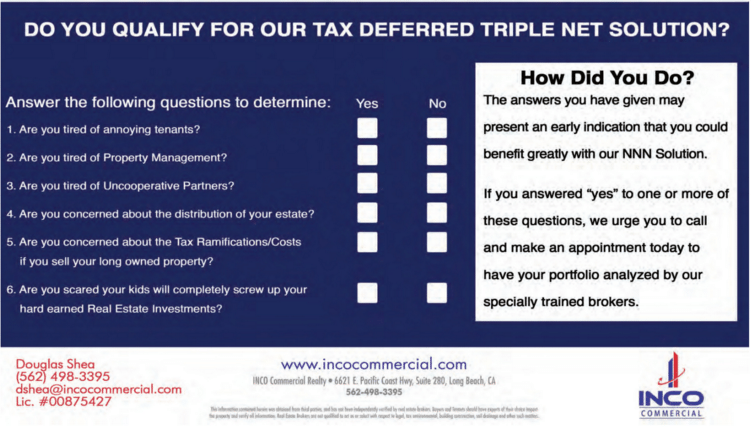

Trust Local Experts

In a venture of this type, some trust becomes necessary — the test is in knowing who to trust. Putting together a team of qualified local experts is a good start in this regard.

Note that “qualified” here means professionals with a proven track-record in real estate investing. Knowledge of the property’s local area and proficiency with technology are also key…

Don’t forget: make sure to ask for video walk-throughs of properties and/or video chats with your team. The function of your team is to vet potential investment properties in-person and report their findings back to you.

Utilize a Local Property Management Company

Let’s assume that the above groundwork has all been laid and you’re now ready to move forward with the purchasing of a property. Your next step is to find and enlist a dependable, local property management company.

Once you’ve performed thorough research regarding your options, hire the one you’re most comfortable with.

Remember: the property management company will be responsible for running your investment’s day-to-day operations; therefore, it’s this partnership that largely determines if your investment stays financially viable.

Establish a partnership based on respect, trust and communication from the very start… and don’t forget the well-drawn contract agreement stating each side’s responsibilities!

1031 Exchange, Remote Investing, and Our Office

Once you’ve decided on a remote investment property, our office can execute your 1031 Exchange. Remember how we said that trusting the experts is key?

To schedule a consultation, call us today at 562-296-1362.